The Opportunity Gap in Early Financial Action

Across classrooms and workplaces, a clear pattern emerges: young people want financial independence but often lack access to the tools and confidence to start. Retirement feels abstract, and the idea of saving for a future 40 years away seems distant—until they understand the power of starting young.

For educators and employers, helping students and young employees understand IRAs (Individual Retirement Accounts) isn’t just financial education—it’s empowerment. The earlier someone starts, the less they need to contribute later to reach the same goal, thanks to compound growth.

Why IRAs Matter

An IRA is a personal retirement savings account that offers tax advantages—either upfront with a Traditional IRA or on the back end with a Roth IRA. For young earners, a Roth IRA often makes the most sense:

- Contributions are made with after-tax dollars.

- Growth and withdrawals in retirement are completely tax-free.

- Funds can even be withdrawn early (under certain conditions) for education or a first home, providing flexibility.

For a high school or college student working a part-time job, the concept is simple: earn a paycheck, invest a little, and let time do the heavy lifting.

The Cost of Waiting

Here's a perspective Troutwood often shares in classrooms and workplace sessions:

- A 20-year-old contributing just $50 per month until age 65, earning a 7% return, could have over $250,000.

- Waiting until age 30 to start? That same monthly contribution grows to only $120,000.

The math is powerful, but the message is even stronger: you can't make up for lost time in investing.

How Troutwood Helps

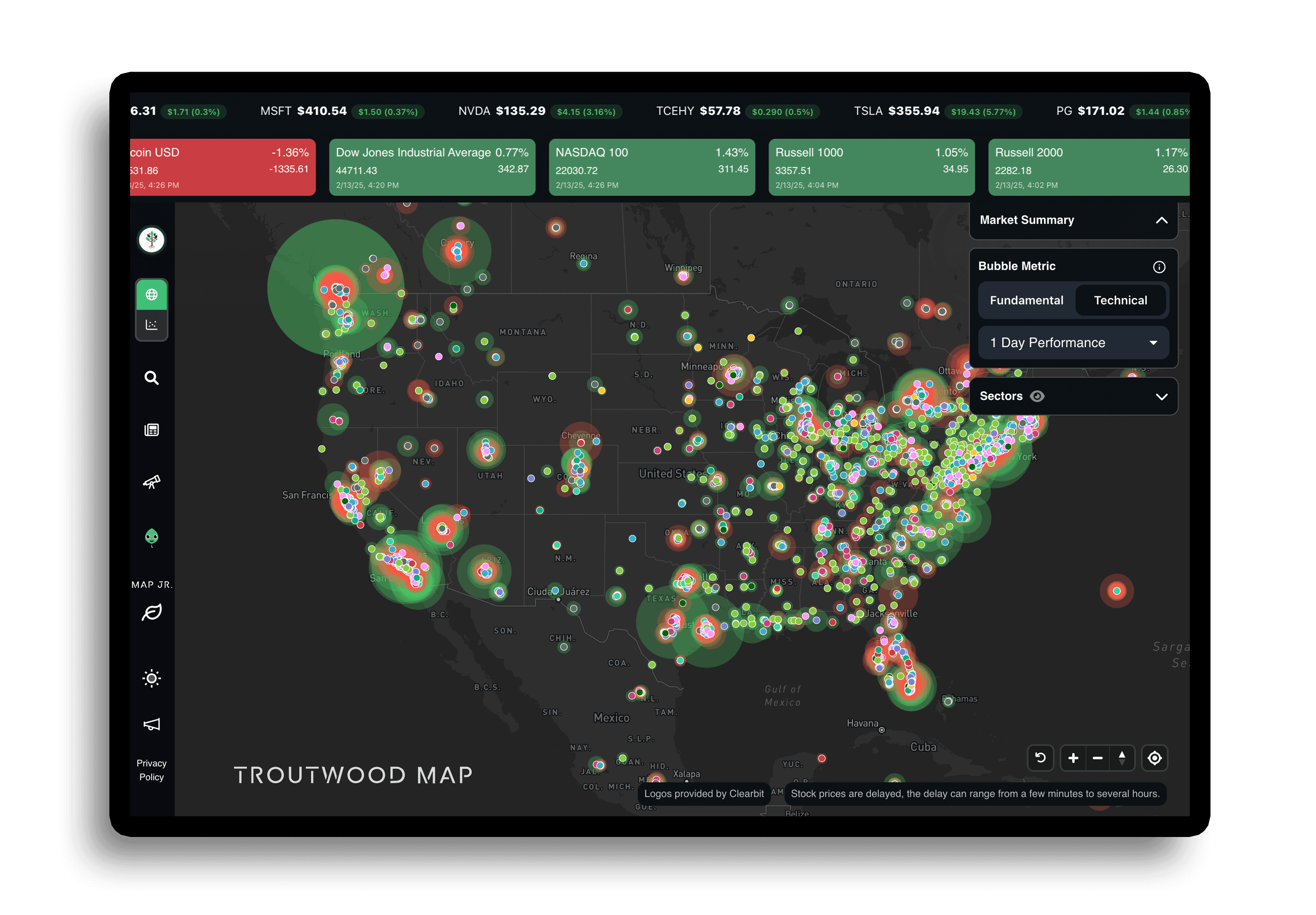

Troutwood bridges the gap between education and action. Through our interactive market map, retirement simulators, and goal-setting tools, students and employees can visualize:

- What starting young really means for their financial future.

- How a few dollars invested early compound over decades.

- That investing isn’t just for “Wall Street”—it’s for everyone with a paycheck.

For educators, Troutwood's classroom-ready tools make retirement education interactive and relatable. For employers, Troutwood's financial wellness platform turns workforce education into lifelong behavior change—helping employees build stability, reduce financial stress, and increase engagement.

A Call to Educators and Employers

The next generation deserves more than financial literacy—they deserve financial confidence. Partnering with Troutwood means giving students and young employees the knowledge, technology, and motivation to start their IRA journey early.

The lesson is simple but transformative: Start small. Start early. Stay consistent.

*DISCLAIMER:* The information presented on or through this article is made available solely for general information purposes. We do not warrant the accuracy, completeness, or usefulness of this information. Any reliance you place on such information is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to the article, or by anyone who may be informed of any of its contents.