Our latest app release is packed with updates to help you manage money more effectively, see your financial data clearly, and streamline account connections. Whether your goal is saving money, paying down credit card debt, or simply getting a clearer month-to-month picture of your income and expenses, these updates make your personal finance experience more accurate, more intuitive, and more powerful.

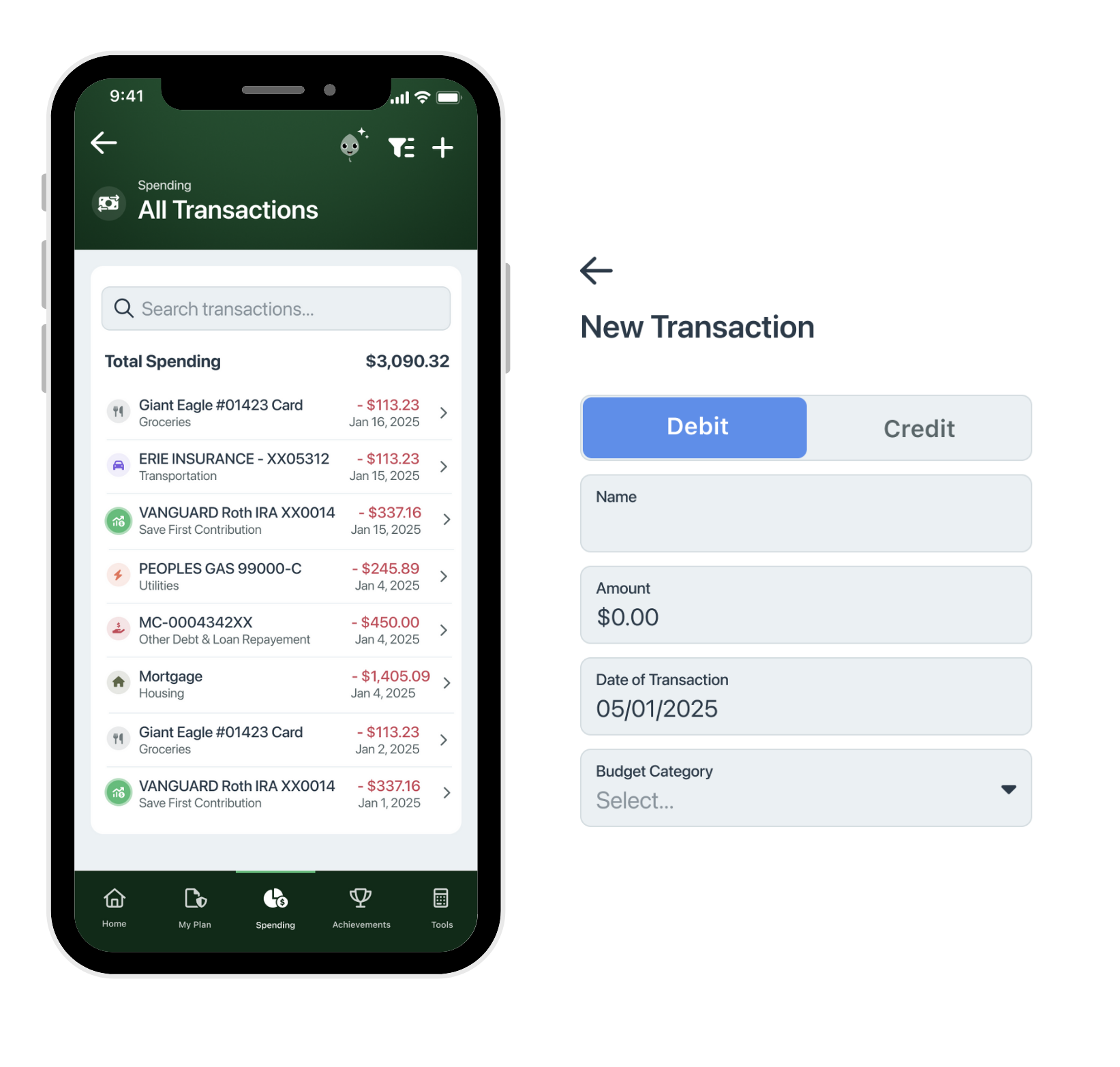

Smarter Transaction Tracking for Manual and Linked Accounts

Now, whether you’re working with manually added transactions or those imported from linked accounts, you can manually mark any transaction as an inflow (money coming in) or outflow (money going out).

Here’s why that matters for your financial situation:

- Accurate tracking for unique transactions – Perfect for reimbursements, gift card usage, loan payments, or irregular deposits to your checking account or savings account.

- Cleaner records for manual entries – Keep your data tidy when you add transactions yourself.

- Automation with flexibility – Preserve automatic categorization while gaining more control at the user level.

This feature helps you create a more accurate record of your income and expenses, allowing you to make better financial decisions month to month.

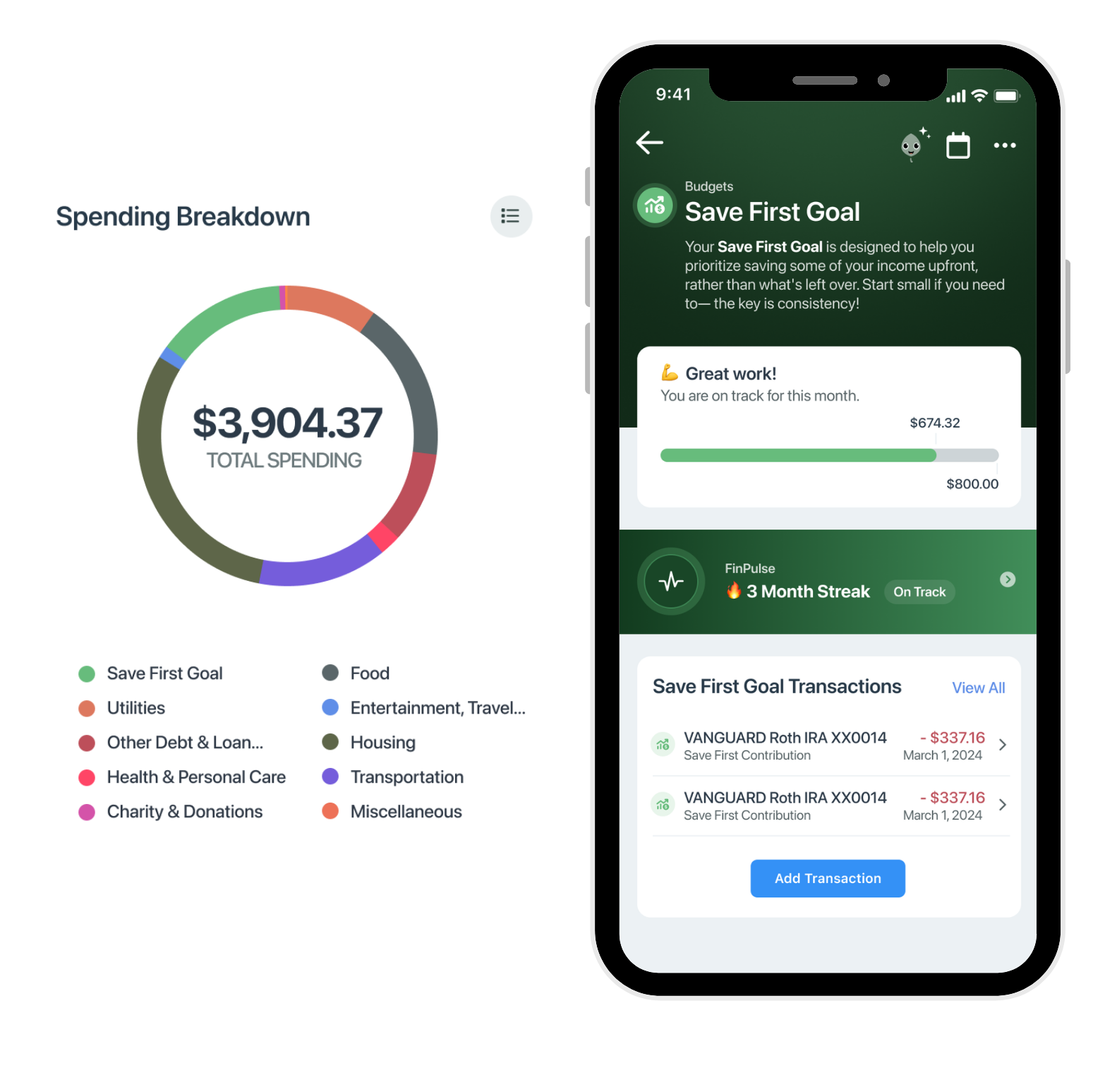

Improved Budget Accuracy with Internal Transfer Logic

If you’ve ever felt like your budget app was “charging you twice” for the same transfer, you’re going to love this. We’ve fixed one of the most common budgeting headaches.

Here’s what’s new:

- No more double-counting — paying a credit card from checking won’t hurt your budget twice.

- Savings and investments still count toward goals – transfers to savings or investments still improve your FinPulse Score.

- Cleaner spending trends – see where your money truly goes without noise.

With this clearer view, sticking to your budget is easier—whether you’re building an emergency fund or paying down debt.

Better Investment Tracking

Your investments are a key part of your overall financial situation, and now you’ll be able to monitor them with more precision.

We’ve improved investment tracking by:

- Separated & categorized – No more confusion between deposits, withdrawals, and investment activity.

- Unified dashboard – See all your accounts, assets, and savings performance together, alongside your income and expenses.

This unified view helps you evaluate short-term cash flow while keeping long-term wealth-building in sight.

Faster Account Linking with Plaid

Managing multiple banks or institutions is now simpler with Plaid Multi-Item Link.

- Connect multiple accounts in one session.

- One login — add everything without repeating credentials.

- Quicker setup so you can start tracking right away.

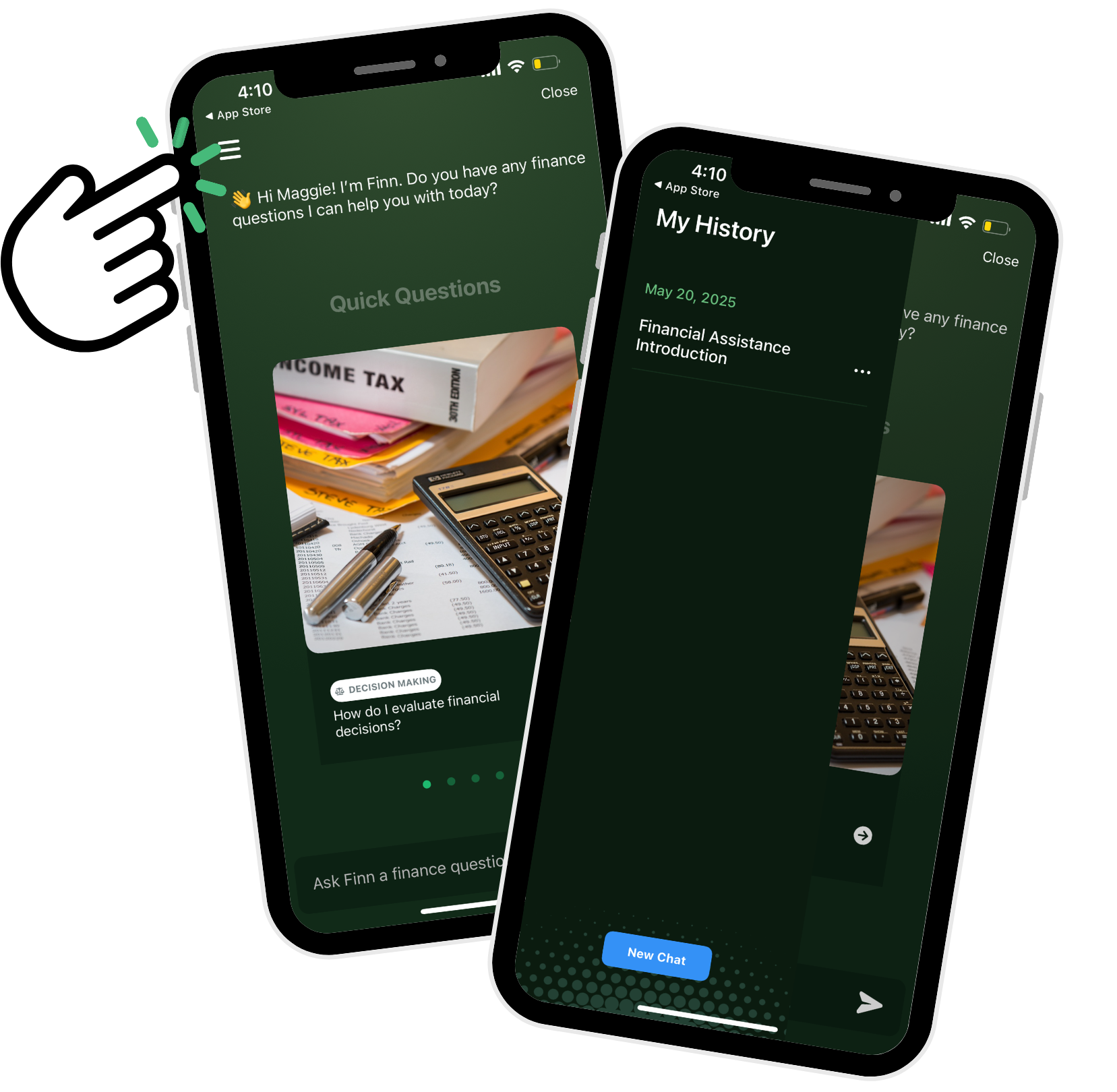

Ask Finn: Smarter AI Support

Our AI assistant, Ask Finn, is more conversational and context-aware. Finn is now a stronger partner for budgeting, goal-tracking, and finding savings opportunities.

- Session-based chat history so you can revisit advice anytime.

- Privacy control — delete past conversations.

- Improved answers — clearer, actionable suggestions.

Performance & Syncing Improvements

Financial data is most valuable when it’s fresh. That’s why we’ve boosted speed and reliability.

- Faster transaction refresh for real-time balances.

- Backend enhancements for smoother syncing.

- Reliable live data for making quick, informed decisions.

TL;DR – What’s New

✅ Mark transactions as inflow/outflow

✅ No more double-counted transfers

✅ Improved investment tracking

✅ Plaid Multi-Item Link for multiple accounts

✅ Ask Finn chat history & smarter answers

✅ Faster syncing and performance