“…but, in this world, nothing is certain except death and taxes." – Benjamin Franklin

Beginning in mid-to-late January of every year, Americans receive tax documents through mail and email from a variety of sources. You may receive a W2 (if you were employed), a 1099 (if you received payments of any type), healthcare documents, local and state documents, and more. Next, it’s time to gather these documents; fill in forms and boxes; file local, state and federal taxes; and hope for a refund. All of this needs to be completed by April 15, or else you need to file an extension.

The first time I filed my taxes, I was 15 years old and worked as a lifeguard and swim instructor.

My dad collected my W2s, brought out his homemade tax calculation sheet, and we dialed the IRS and filed my taxes through a touchtone phone. I did not receive a tax refund that year.

As I grew up, the documents I collected changed as my life changed: student loan interest, unemployment benefits, real estate tax, child and childcare deductions, investment portfolios. But no matter what documents I had to file, I always, always wanted that tax refund. And I would use the refund to go on vacation.

In 2025, it is projected that 140 million Americans will file their taxes.

Of those people filing, 58% are expecting to receive a tax refund. In 2024, the refund amount average was around $1700. A majority of Americans already have plans for their tax refunds, including paying bills, paying down credit card debt, home improvements, and luxuries such as a phone upgrade or a shopping spree.

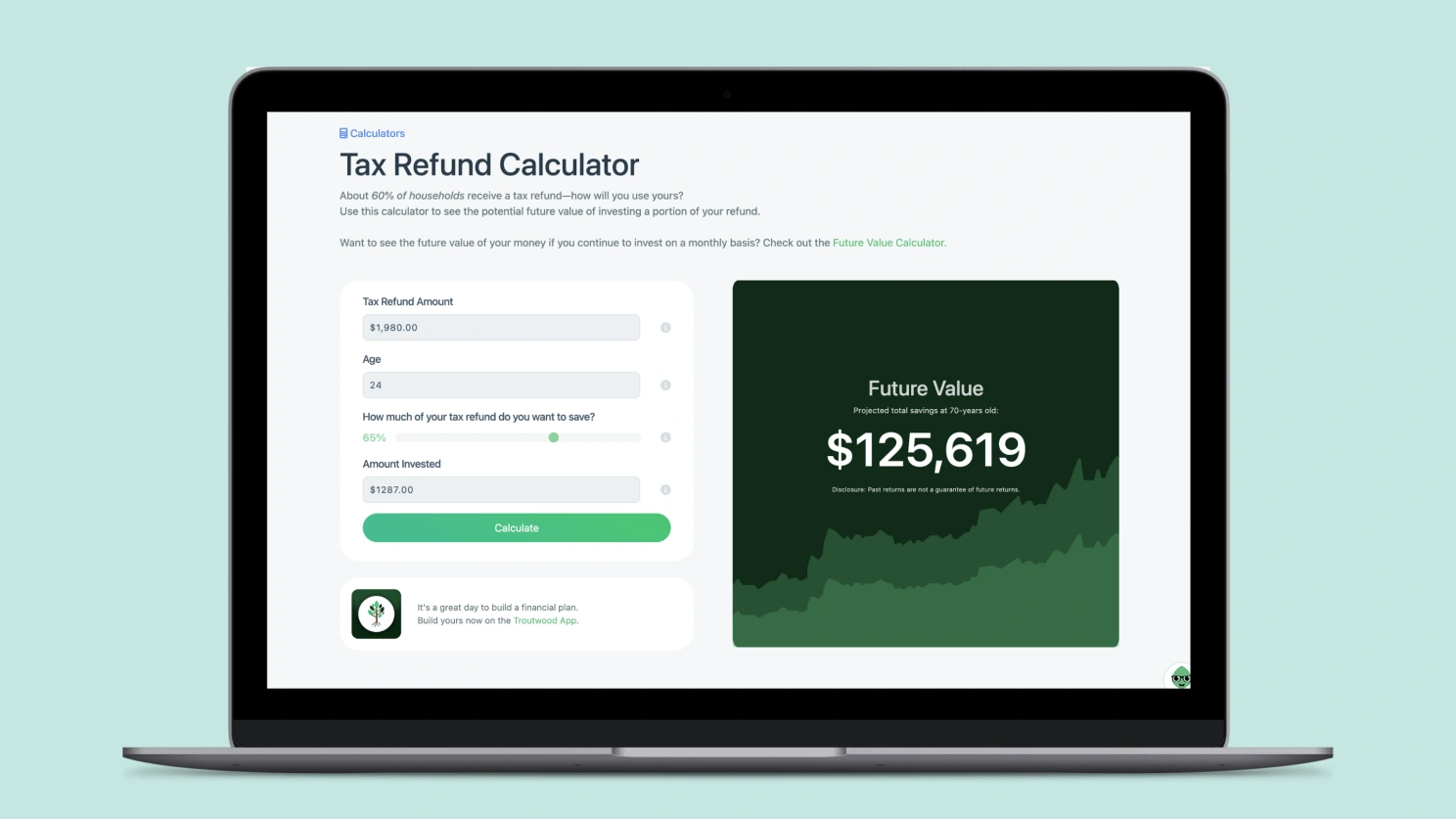

So why is Troutwood talking about tax refunds? Receiving unexpected money, no matter how big or how small, creates the opportunity to level up your financial future. Setting aside a portion of your tax refund into an investment account will provide a source of income for you in the future. That is why Troutwood built a tax refund calculator: to show the value of investing in your future. Before investing, explore the map at map.troutwood.com to understand different market sectors and how companies perform over time.

Check it out here: Tax Refund Calculator

If you don’t have an IRA or investment account or don’t know where to start, Troutwood has some short videos to help you out (all under three minutes, we promise):

Roth IRA Basics

Investing Unraveled: Empowering Financial Futures

We also encourage you to create a financial plan. Maybe it is your first one, maybe you have a great handle on your finances, but you want to explore different scenarios. Check out the Troutwood App (it’s free!) and build a plan.

Use your refund to pay your bills, take that vacation (maybe you don’t need to upgrade to first class seats), buy the new rug you saw on Insta, but also invest some of it as well. Even if it is 5% of your refund, your future is worth it.

*DISCLAIMER:* The information presented on or through this article is made available solely for general information purposes. We do not warrant the accuracy, completeness, or usefulness of this information. Any reliance you place on such information is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to the article, or by anyone who may be informed of any of its contents.