- State Street is not an asset class and your employees are asking because they don't know that.

- It's important for you to know, that they might not know.

I received a phone from a past student and current employee at a Fortune 500 company who was attempting to set

up his company sponsored 401k. He asked, "Gene, what asset class is State Street, and how much should I

invest in it?" I directed him towards his company's HR department.

What if he wouldn’t have asked the question?

When it comes to money there are consequences to not knowing. What if something as simple as a list of State

Street mutual fund ticker symbols kept one of your employees from enrolling in their 401k, missing out on the

company match, and on years of meaningful time to be invested?

Similarly, a friend who worked for a large publicly traded company called a few years ago and asked me how her

401k was doing. I’m not a financial advisor, don’t manage people’s money and had no reason to have insight

into her 401k plan. I said “I don’t know.” She replied, “How do I find out?”

After a short conversation, I also directed her to company HR, where she learned she had not signed up for the

company 401k when she was hired, two years earlier. She did not have one. To her credit, she moved quickly to

correct this mistake, but it’s one that should never have happened. This friend had a Masters degree in

Marketing and was an excellent employee. She simply didn’t know.

What if she wouldn’t have asked the question?

Would 2-years have become 5 or 10-years? Fortunately she did.

68% of working Americans have access to a 401k, 17% of whom do not participate. This means 1 in 4 employees

with a 401k, don’t participate in said 401k. This is called “opting out.”

There are a multitude of reasons why an employee might opt out of the 401k. In a world where Pension Funds

are rare, fear and lack of understanding shouldn’t be two of them!

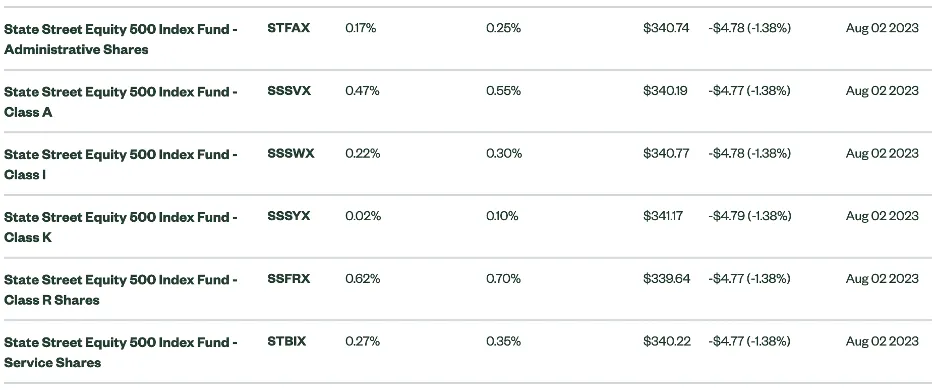

State Street is an investment company that manages mutual funds on behalf of 401k participants. These mutual

funds are invested in stocks and/or bonds. There is often a great deal of asset class overlap in 401k fund

options, and it's a place where pitfalls can and do happen.

Maybe you have an employee who has heard of the S&P 500. But, can they (or you) decode the difference between

the 6 options State Street lists?

This example is not unique to State Street. A search for "S&P 500" on Vanguard's website, yields 243 results.

Folks who now work in finance quickly forget what they didn't know before being in the field. A jargon audit

followed by an intense UI/UX review would be a good starting point to help employees better understand their

financial options.

401k’s are an important source of retirement income. Let’s do better as an industry to help ensure our

employees and plan participants can successfully navigate the set-up process.

My wife is a physical therapist, a very good one. At home she’ll describe her day, and sometimes

instead of of calling the “knee” the “knee," she will call it an obscure term I’ve not heard of. Note, she

does this intentionally at home, and never at work. The lesson, call a knee a knee and don’t take for granted

what your employees may or may not know.

*DISCLAIMER:* The information presented on or through this article is made available solely for general information purposes. We do not warrant the accuracy, completeness, or usefulness of this information. Any reliance you place on such information is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to the article, or by anyone who may be informed of any of its contents.