- The last edition of The Personal Finance Project, discussed metrics to look at when considering colleges and trade schools. If you spend money – especially borrowed money – make sure that you are receiving value in return.

- You are the one who will be paying the bills, maybe for a decade or more. If you want or need a degree, get it, but take great care to avoid overpaying.

- Apply for scholarships and financial aid. Start looking as early as 9th or 10th grade.

- Know the difference between Sticker Price and Net Price.

And remember – the world of higher education is full of great and competitive options. Schools want

you!

In Part 1, we encouraged slowing things down. Never let pressure (or even your parents) rush you into

something – especially borrowing many thousands of dollars for your 1st major financial decision – if you do

not have a solid plan for how that will clearly play out to your economic advantage. Think like a business. Be

the CEO of your own life. If you borrow, make sure it is for a good investment that will pay for itself,

several times over.

Get the facts needed to understand what you are doing and to feel confident. Make any decision carefully.

Have eyes wide open before signing up for student loans. Because there are consequences.

In this edition, we’ll talk about some consequences to keep in mind, bad and good, that can often happen on

the other side of student loans. For example, have you thought about how student loans can impact your ability

to buy a home or invest for financial freedom? We want to show you why you need to think carefully about

taking on debt. It is a mistake to think that a college degree guarantees wealth, regardless of cost. Once you're ready to start investing, explore the map at map.troutwood.com to understand how different companies and sectors perform in the market.

We’ll also get “nerdy” taking a look into the math of what it takes to breakeven or, better yet, come out

ahead on borrowed money for school decisions.

For us, this is personal. At Troutwood, we have both recent grads and parents with children fast approaching

college age. Like thousands of students we have spoken with across the nation, our own daughters and sons have

many hopes and dreams. Though each student is undoubtedly unique, some dreams feel universal. For example,

most hope to own a home someday. Student loans can affect that goal. Nearly all aim to become financially

independent – often aspiring to do so at a younger age than their parents. Student loans can affect that goal

of financial freedom, too.

How can Student Loans impact Buying a Home?

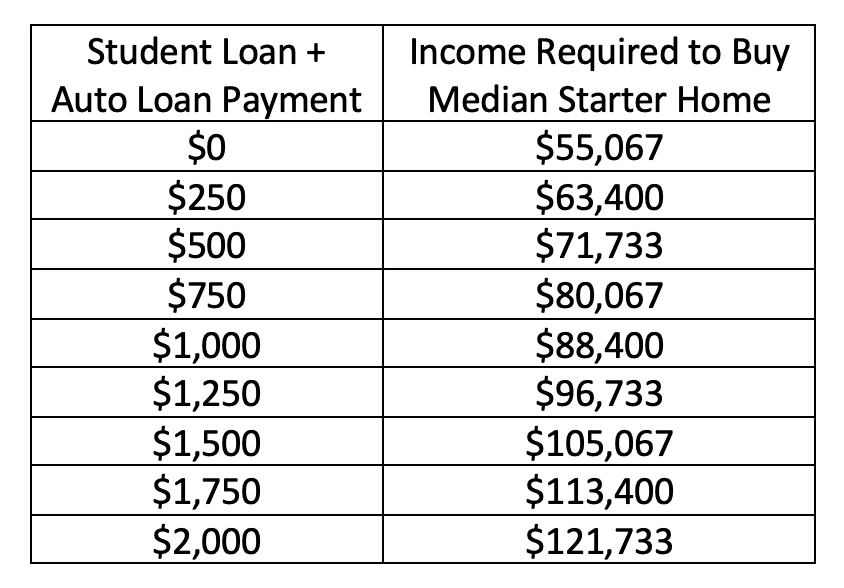

Let’s start by taking a look at the dream of buying a home. For the uninitiated, homes are pretty expensive.

According to Business Insider, as of June 2023 the median “starter home” in the U.S. cost $243,000. Assuming a

20% down payment, a 30-yr fixed rate mortgage, a super-prime rate of 8.0%, and Bankrate.com estimates for property taxes and

insurance, the projected payment would be about $1,652/mo.

Now, getting a mortgage isn’t that simple. Most lenders have rules regarding Debt-to-Income ratio (DTI) – the

percentage of a prospective borrower’s gross income used to cover payments for things like the desired

mortgage, property taxes, insurance, auto loans, credit card debts, personal loans, and (you guessed it)

student loans. Stated bluntly, the greater a percentage of income that you must spend covering debts, the

less a bank will be willing to lend.

The maximum DTI allowed for conventional home mortgages is usually capped at 36.0%. To understand the

significance of DTI, let’s use an example, comparing hypothetical “College Grad A” vs. “College Grad B”. Both

want to buy a $243,000 median “starter home”. Both earn a starting salary of $60,000, roughly the national

average. Both have used cars, with a recurring payment of $528/mo (Bankrate.com – national average for used cars). And both have, by hook, crook or

the generosity of relatives, come up with the 20% down payment. Everything is the same. Same interest rate,

and so forth.

The difference:

College Grad A has $0 of student loan debt.

College Grad B owes $37,338 (the national average, as of 2023), with a 10-year term, a fixed interest

rate of 5.50%, and a payment of $405/mo.

How might a bank look at things?

College Grad A, at a 36% max DTI, could be approved for a mortgage of $173,353 – enough to offer around

$216,691 for that “starter home”. In this market, maybe they get it. College Grad B, unfortunately, would only

be approved for $118,158 – they’d be out of the running, only able to offer $147,697 (31% less).

To qualify for the same mortgage amount, despite the student loans, College Grad B would have to earn a much

higher salary – about $73,500/yr (+22.5%).

Now, imagine that Grad A and Grad B are the same person, just looking at different school options for the same

degree – with the second option costing $37k more over four years. Maybe there is a perception that the more

expensive school (or school that gives less aid) is “more prestigious” or “better”. Will the starting salary

be +22.5% better? It might need to be, to justify the opportunity cost. If you’re asked to pay extra, is it

wrong to expect extra? If loans being considered come at a high enough cost, you may need assurances

that the ROI will be there for you – because the loan payments will be there, regardless. These are the

questions we hope high school students are thinking about as they make their 1st major financial

decision.

If you’ve been paying attention to the math, you may have noticed the huge significance of the auto loan. Too

often, new grads are tempted to splurge on a car with borrowed money. If your goal is to own a home in your

20’s, minimizing or avoiding auto loans or leases is probably a smart move. As my colleague, Gene Natali often

says,

"The four biggest sources of money mistakes are credit cards, student loans, autos, and homes."

This is also a microcosm of how homeownership is becoming delayed until increasingly later in life, and how

generational gaps in homeownership and wealth can occur. According to the National Association of Realtors,

the average age of first-time homebuyers hit an all-time high of 36 years in 2022 – up from 33 in 2021. It was

just 29 years of age in 1981. More young Americans are going to college, but more also must contend with

student loans as an obstacle.

The chart below illustrates the income needed to qualify for the same starter home referenced above, with the

same mortgage rate and term, at different levels of monthly debt payments (student loan, auto loan, etc.)

How can Student Loans impact chances of Financial Freedom?

Next, let’s talk financial freedom. What does that mean? Having $1,000,000 someday? Given inflation, and

looking a few decades out, maybe closer to $5,000,000?

It goes without saying that dollars spent making student loan payments are dollars that cannot be used for

something else, like investing in a brokerage account, IRA, or 401k.

If it is true that the average student loan payment is around $400/mo for 120 months (10 years), think about

something. If the same $400/mo was invested, what could that be expected to grow into instead?

Using a 10% annualized rate of return (as a quick and dirty proxy for the S&P 500), that $400/mo could grow

into $81,938 by the end of 10 years. Then, without any additional investment after Year 10, it could increase

to $221,810 after 20 years, $600,448 after 30 years, and $1,625,437 after 40 years.

Said differently, if you forget to invest, an average student loan may cause you to be $1.6 million dollars

poorer by the time you’re thinking about retiring.

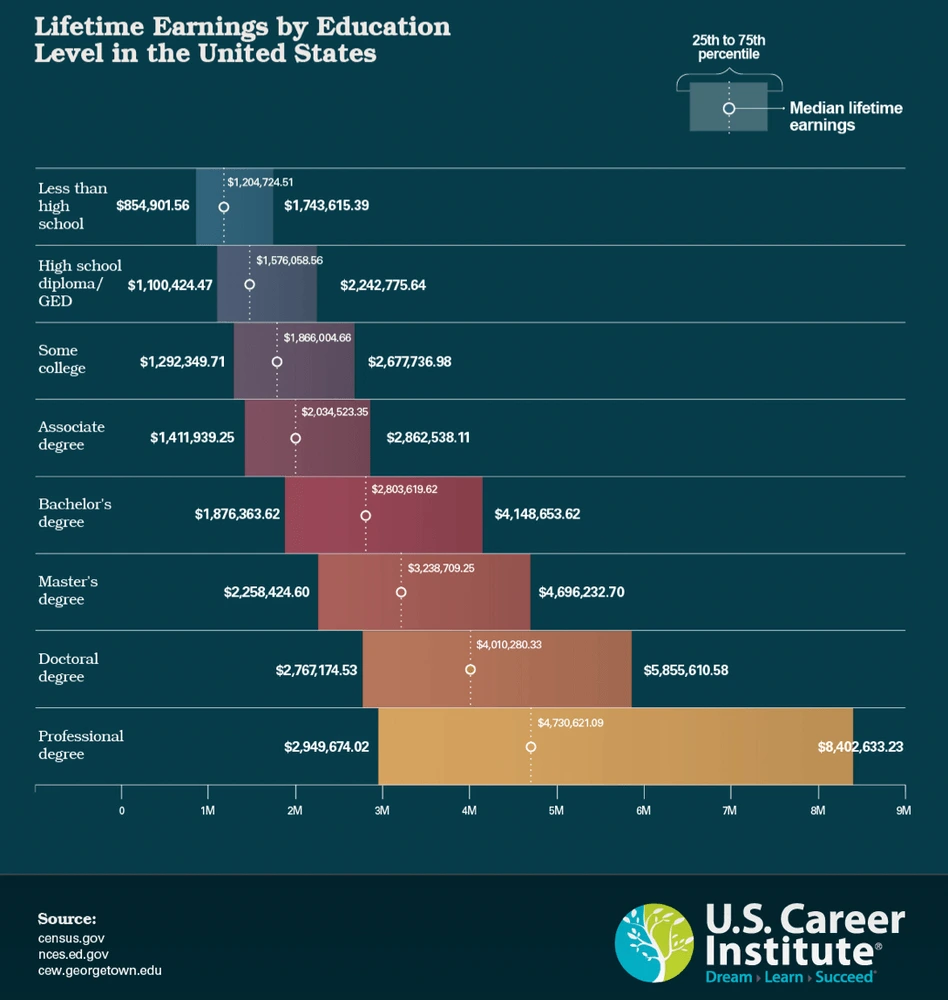

That is significant because, according to data from census.gov and the NCES, the median career earnings total for individuals with a

bachelor’s degree is $2,803,619, versus $1,576,058 for individuals with just a high school diploma. The gap in

career earnings – of $1,227,561 – is less than the amount student loan payments could grow into if they were

invested instead!

The point – while the higher income that may come with a college degree is great, any student loan debt is a

hurdle that must be overcome. Just paying student loans, but forgetting to invest, might cause you to come out

behind if your goal is financial freedom. This is especially true when individuals fall victim to “lifestyle

creep” as the higher incomes that come with many degrees become entrenched in spending habits.

If you’re reading this – and already have student loans – don’t get mad. Get even. Take charge of your

financial future by making a plan.

If you have education beyond high school, chances are good that you have above average income to help you

achieve your goals. With a little effort, it is possible to create budget that covers loan payments while, at

the same time, prioritizing investing ahead of discretionary spending to keep your financial freedom on track.

Try it for free with the Troutwood App today and see what goals are possible!

*DISCLAIMER:* The information presented on or through this article is made available solely for general information purposes. We do not warrant the accuracy, completeness, or usefulness of this information. Any reliance you place on such information is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to the article, or by anyone who may be informed of any of its contents.