Employee engagement and motivation strategies are often treated like a checklist: offer a retirement plan, schedule a few wellness seminars, maybe roll out a survey. Yet utilization rates stay low, and HR leaders are left wondering what actually works.

The truth is, employees don’t want another generic benefit. They want tools that make their lives easier, reduce stress, and help them feel in control of their future.

That’s why financial wellness is one of the most powerful drivers of employee engagement—and why Troutwood is redefining what an employee engagement tool can be.

Why Financial Wellness Matters for Engagement

Money stress doesn’t stay at home—it follows employees into the workplace. Research shows employees struggling with financial uncertainty are:

- More distracted and less productive.

- Less likely to participate in benefits like retirement plans.

- More likely to leave for another employer.

By giving employees access to tools that help them plan, save, and visualize their future, organizations can improve motivation and retention. In fact, financial wellness is both an employee engagement and motivation strategy and a proven employee retention strategy example that works across industries.

How Troutwood Drives Engagement

Troutwood was built to solve the engagement problem. Instead of broad, one-size-fits-all advice, every employee builds a personalized financial plan in minutes using real data.

Here’s what makes Troutwood different:

- Personalized Plans, Not Generic Advice:

Employees can create financial plans tailored to their income, location, and goals, and can even link their 401(k) or pension to see real projections. They can also explore the map at map.troutwood.com to understand how their investments are allocated across different market sectors. - Engagement That Lasts:

This point mentions "achievement streaks" and "employer-designed incentives," with the sentence trailing off, suggesting the document continues beyond the visible portion. - Smart Insights, Simple Actions:

Our AI-powered guidance provides nudges that are easy to understand and act on—no jargon, no fluff. - Enterprise Visibility

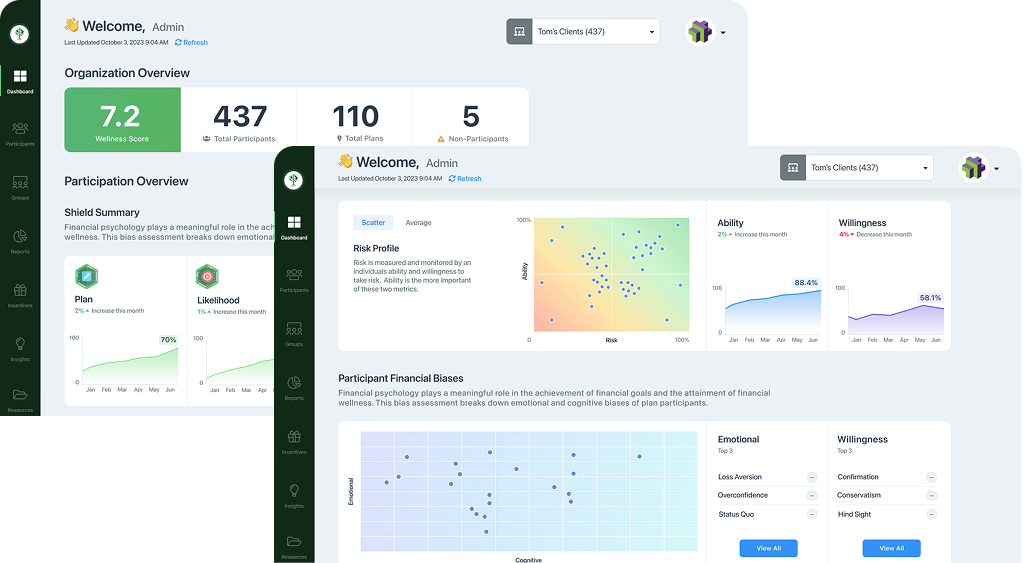

HR teams get dashboards that track engagement, utilization, and outcomes—making it easy to measure ROI and employee utilization rate.

Client Spotlight: Sports CLUB Naples, FL

Real-world feedback shows just how powerful Troutwood can be for engagement and retention.

“We are a small non-profit that does programs for children. Having the Troutwood App has helped our employees better understand how to make their money work more efficiently. Additionally, it has created an awareness of the importance of planning for the future. One of our employees just purchased a vehicle and having the Troutwood App helped her save funds to get the much-needed transportation she needed. I highly recommend this to organizations as it not only helps employees personally, but is a vital tool for employee retention.”

— Bill Carufe, Chief Operating Officer, Sports CLUB, Naples FL

This testimonial highlights what many HR leaders are searching for: a solution that is simple, effective, and impactful on both employee lives and retention.

Employee Retention Strategy Example: Highpoint

When Highpoint introduced Troutwood as part of an August staff challenge, employees were asked to:

- Create a Troutwood account

- Build their financial plan using guided tools

- Link a 401(k) or investment account

Participation surged because employees weren't just checking a box—they were building something meaningful. Incentives and recognition kept motivation high, and engagement carried forward beyond the challenge. This is the kind of employee retention strategy example Troutwood helps organizations replicate.

Measuring Engagement With Utilization Data

Most benefits fail because engagement can’t be measured. Troutwood solves this with clear, actionable metrics:

- Employee utilization rate — how many employees actually use the tool

- Progress tracking — retirement readiness, savings goals, budgeting habits

- Engagement trends — streaks, incentives, and usage over time

For HR leaders, this visibility turns financial wellness from a "soft" benefit into a measurable engagement driver.

The Bottom Line

Employees want more than perks—they want tools that help them feel secure, motivated, and valued. Troutwood delivers exactly that: a new age financial wellness benefit that drives real engagement, improves retention, and provides measurable outcomes.

When financial planning becomes accessible to everyone, employees gain confidence, organizations see stronger engagement, and HR finally has the data to prove impact.

Troutwood isn't just another benefit. It's the benefit employees will actually use.

👉 Ready to see how Troutwood can power your engagement strategy?

*DISCLAIMER:* The information presented on or through this article is made available solely for general information purposes. We do not warrant the accuracy, completeness, or usefulness of this information. Any reliance you place on such information is strictly at your own risk. We disclaim all liability and responsibility arising from any reliance placed on such materials by you or any other visitor to the article, or by anyone who may be informed of any of its contents.