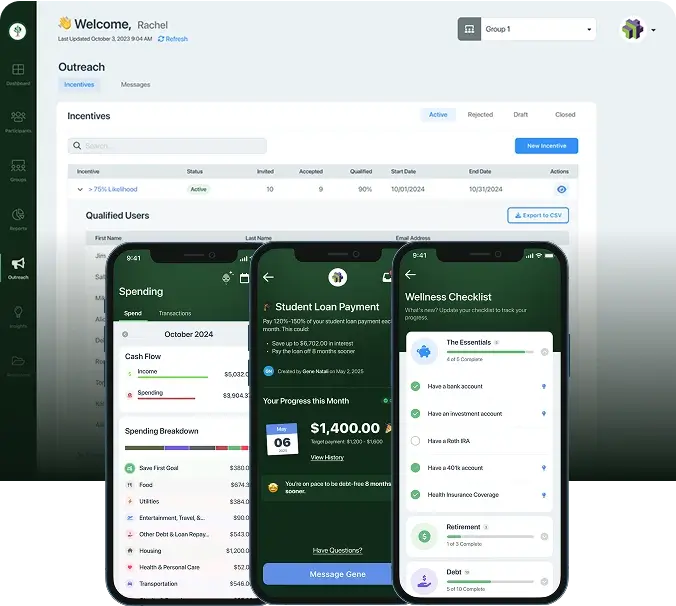

Drive engagement.

Interactive tools and incentives that keep employees connected to their financial goals—and to your organization.

Deliver financial wellness.

With a platform that builds and supports lasting financial confidence.

Improve employee retention.

Support your people’s financial well-being and watch loyalty, productivity, and trust grow.